Payment Requests

The Payment Request form in PAW Procurement System (PPS) will be one of several ways to make a payment. Payment Request form may be used for:

Payment Request form should *NOT* be used for:

-

- Invoices over $600

- Travel Expenses (when using accounts 7040100, 7040300, 7040330, etc)

- Subaward payments (there is a separate form for subawards)

After accessing PPS, locate the Forms area and select the Payment Request form.

PAW Payment Request Instructions

Payment Request Frequently Asked Questions (FAQs)

Authorizations

We delegated authorization to our department administrator in PAW, why do we have to supply additional levels of authorization for certain transactions?

The Payment Request form was designed to process transactions less than $600 for standard business reimbursements. However, in practice, transactions of all types and amounts much greater than $600 occur in Payment Requests. These include:

- Student Reimbursements for Class Supplies

- Final Payments for work performed after the Expiration of Contracts

- Meals for large groups

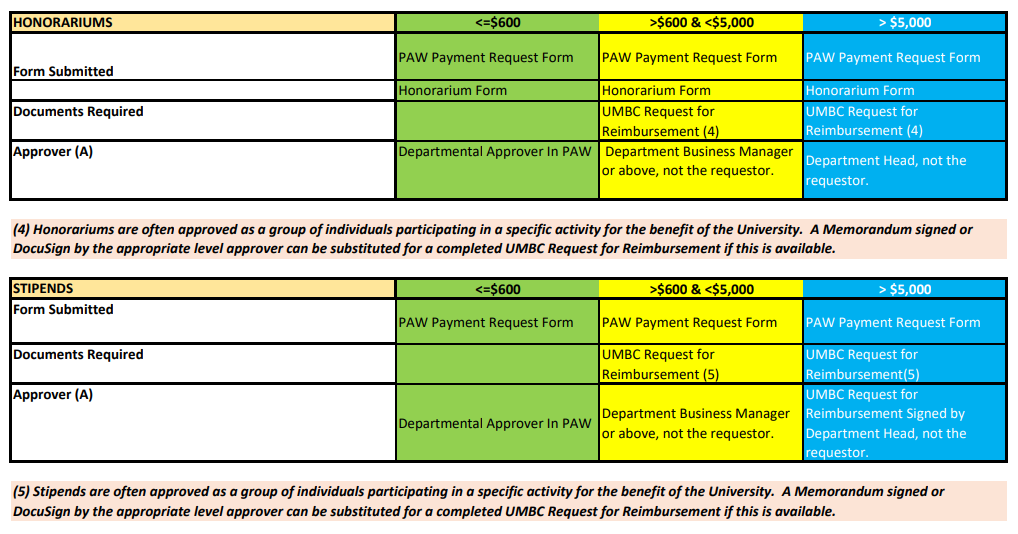

- Large Honorariums

- Large Stipends

When establishing electronic authorizations, the State requires that we consider:

- Proper review procedures are in place to prevent, detect or correct errors and irregularities. Reviews should be made for validity, completeness, authorization, accuracy and proper classification.

- Proper authorization of transaction (approval paths) should specifically delineate the lines of authority from the highest to the lowest level position.

The additional levels of signature authority are designed to insure appropriate levels within the organization are reviewing financial transactions based on the type, amount and nature of the transaction.

Do the normal limitations for UMBC fund disbursements apply if being reimbursed by foundation funds?

NO. Please include the Disbursement Request Form authorizing the reimbursement from the foundation.

Prior to PAW we always stamped invoices “OK to PAY”. Is that still required?

Central is looking for the authorizations as noted in the Comprehensive Guidance. Internal procedures such as the “OK to PAY” stamp are not required but may still be important for your division, please check with your business manager.

Our department has forms we have adopted in order to collect, process payment requests, are we required to abandon those forms and adopt the standard forms you are providing?

Most of the forms necessary in order to process payment requests allow for substitutions. If the forms you have internally created address the minimum requirements as we outlined on the Forms Overview, then you can use your departmental forms. If they do not meet those requirements, we would ask that you update them so that they do or adopt our standard forms.

We have a small department with a department chair but no business manager, how can we have items approved that require a business manager’s approval?

Department Chairs are a higher level approver than business managers, you can always have higher level approvers approve lower dollar items, just not the other way around.

Our Department Chair has stated that they want to approve all items over $600, does the new guidance mean that they will now only be approving items over $5,000?

No, the guidance provides the minimum standards we require in order to process payment requests. If your department head/chair determines that they wish to institute a stricter standard (i.e. lower dollar thresholds) then for your department that standard should be adhered too. The purpose of our guidance is to provide a minimum standard not a threshold mandate.

Can I be reimbursed for furniture I purchased for a home office I use to Telework?

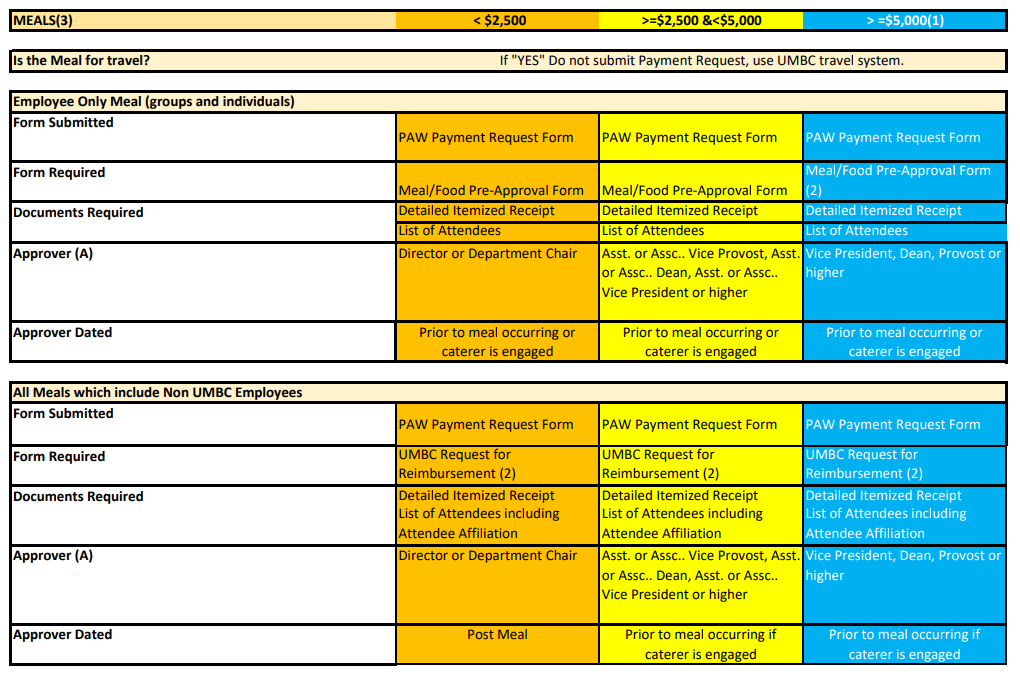

Meals

How much will UMBC reimburse me for meal expenses?

Per USM policy meal expenses should normally be reimbursed based on the stated per diem rates as approved by the Chancellor on an annual basis.

The per diem rates are broken down by meal and include tax and tip.

When Faculty or Staff submit reimbursements in excess of the per diem rate it may be flagged in audit by GAD and returned for further justification. We advise campus community members to bear in mind the currently effective per diem rates when submitting meal reimbursements. Departments should be prepared to provide additional justification if reimbursements exceed per diem.

Will I be reimbursed if I leave a tip?

The GAD guidance on tips is that no more than a 20% tip should be reimbursed. All tips up to 20%, excluding tax will be reimbursed.

Our department is hosting a recruiting candidate, do we still need the request for reimbursement form?

Request for reimbursement forms may be omitted by the department when meals are purchased for candidate recruitments. Please submit:

- Detailed Receipts

- Candidate Recruitment Agenda

- List of attendees to each meal

Our department is hosting a recruiting meal for a candidate and their spouse, is the spouse’s meal reimbursable?

The spouse of a candidate is not eligible for reimbursement of their meal expenses.

What constitutes a detailed meal receipt?

Detailed receipts include a listing of all items purchased at the restaurant as well as the tip.

Invoices

What information should be included on an invoice when we submit it for payment?

Every invoice should clearly show the name and address of the State agency being billed.

UMBC

1000 Hilltop Circle

Baltimore, MD 21250

The invoice must sufficiently describe the details of the goods or services being paid including the date that the goods or services were rendered and the date of the invoice.

Each invoice must contain the vendor’s name, remittance address and federal taxpayer identification number or, if owned by an individual, his/her social security number.

I can’t find the original invoice, can I submit the statement I received for payment?

Statements cannot be used as documentation to substantiate a payment. If you are unable to locate the vendor invoice you should contact the vendor directly and ask for a duplicate invoice.

Upon submission of the invoice you must certify in writing that the duplicate should be used as an original by writing on the invoice:

Please use as original.

This invoice has not been previously paid.

______________________________________

Signature Date

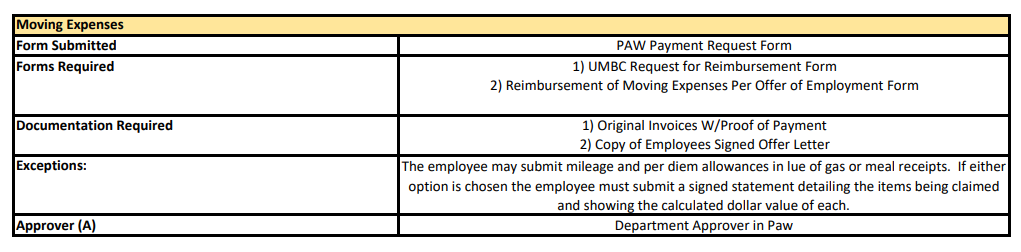

Moving Expenses

Why do I need to include Pcard expenditures paid by the department on the REIMBURSEMENT OF MOVING EXPENSE PER OFFER OF EMPLOYEMENT form?

All payments made for the benefit of or reimbursements made directly to the Employee are considered taxable income by law. Upon receipt of the form, Accounts Payable will report total income paid to Human Resources so that the appropriate taxes can be withheld.

General

What is the most common problem you see that results in delayed/returned payment request?

The most common problem resulting in delays and returned payment request is that the invoice/support provided does not match the W-9 for the supplier being paid. Be sure that your supplier’s invoice matches the W-9 supplied or we will have to return it to you for follow-up with the supplier.